Form 1099 K

Advertisement

Form 1099 S Real Estate Software v.2011

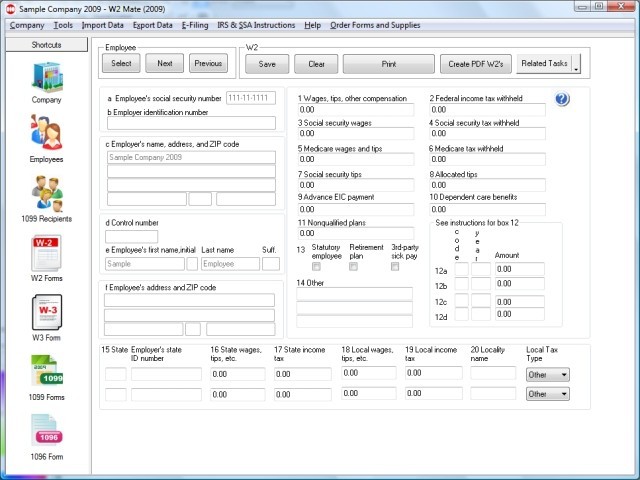

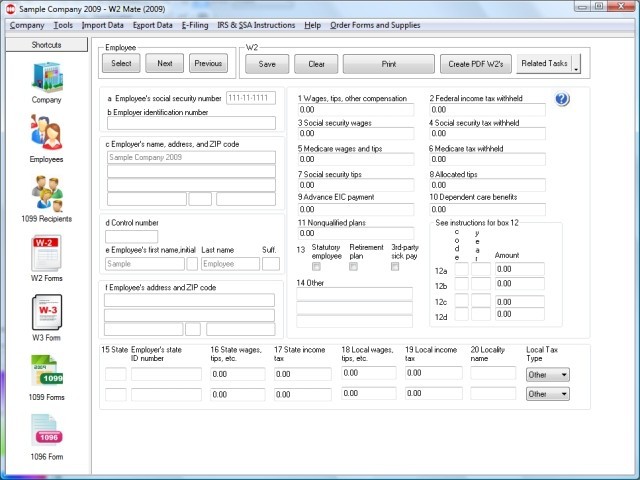

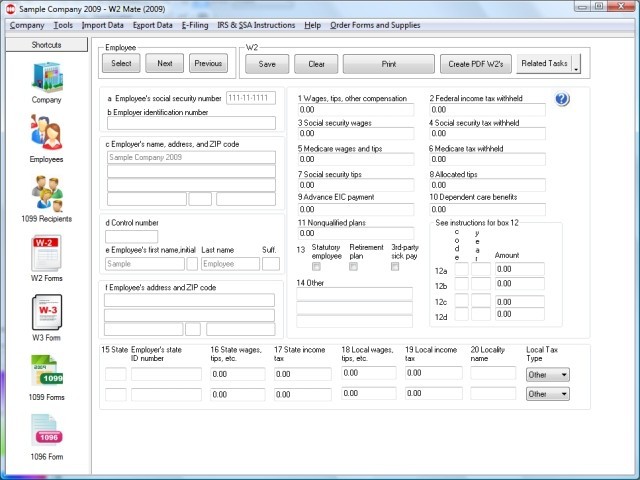

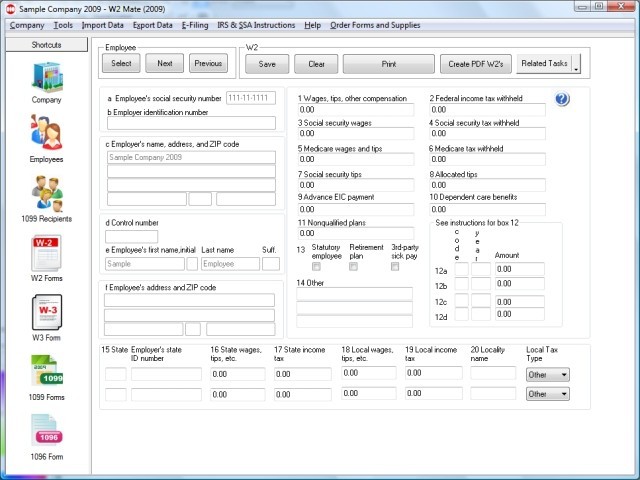

W2 Mate is 1099-S Software used to prepare IRS Proceeds from Real Estate Transactions 1099 S forms.

Advertisement

1099 R Software v.8.0.18

IRS Tax Form 1099-R is used to report designated distributions of $10 or more from Pensions, Annuities, Profit-Sharing and Retirement Plans, IRAs, and Insurance contracts.

1099-SA v.1

File Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA, to report distributions made from HSA, Archer MSA, or Medicare Advantage MSA (MA MSA).

1099-R v.1

A Form 1099-R is generally used to report designated distributions of $10 or more from pensions, annuities, profit-sharing and retirement plans, IRAs, and insurance contracts.

1099 DIV Software v.8.0.18

W2 Mate is 1099 DIV Forms Software used to import, process, prepare, e-mail and e-file IRS 1099 DIV forms and W2 Forms.

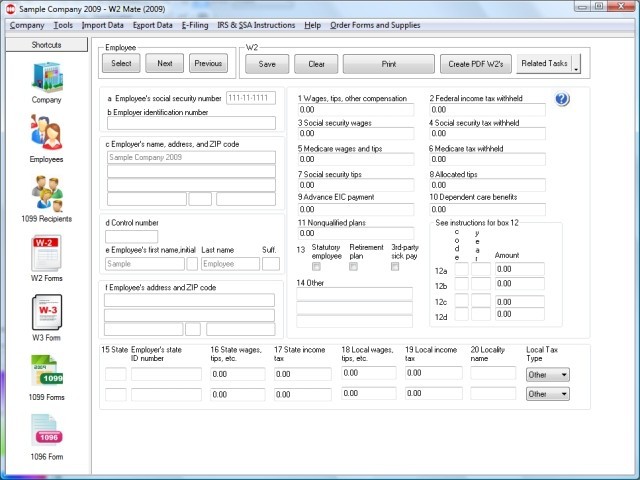

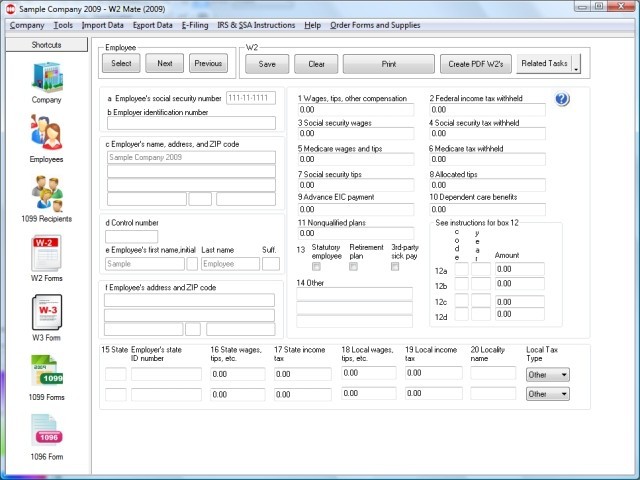

1099 Software

1099 Software for importing, preparing, printing and E-filing 1099 forms and W2 Forms. Unlimited number of companies, employees, recipients, 1099 forms and W2 Forms. This 1099 Software is very easy, yet powerful and comprehensive. Our 1099 tax software is

1099 Pro Professional v.1.0

The 1099 Pro Professional Edition is the easiest and most advanced software for all your paper filing needs. It prints to plain paper, preprinted forms and continuous forms.

Account Ability Tax Form Preparation v.22.00

Account Ability prepares information returns (1098, 1099, 3921, 3922, 5498, W-2G) and annual wage reports (W-2, W-2C) electronically, on laser, inkjet and generic dot matrix printers. IRS Bulk TIN Matching is included for free.

EASI Tax v.2006

EASITax provides a fast and easy way to fill and print large numbers of 1099 and W2 forms and transmittals. You can import the fill data from a comma delimited file, or type it in manually with an option to repeat payer data on each form,